Capitalytics in Action: How to Identify Peer Banks with Capitalytics

Mon Mar 25, 2013One of the points that we have made several times is that the details of the business model for a given bank has a dramatic impact on what other banks should be considered to be peers, and what other banks should be used for comparison purposes. While it is very easy to simply look at the 10 or 15 closest banks that are comparable in size to your own and declare them as "peers", banks which emphasize commercially oriented lines of business, as opposed to consumer oriented products, will succeed based on different market conditions.

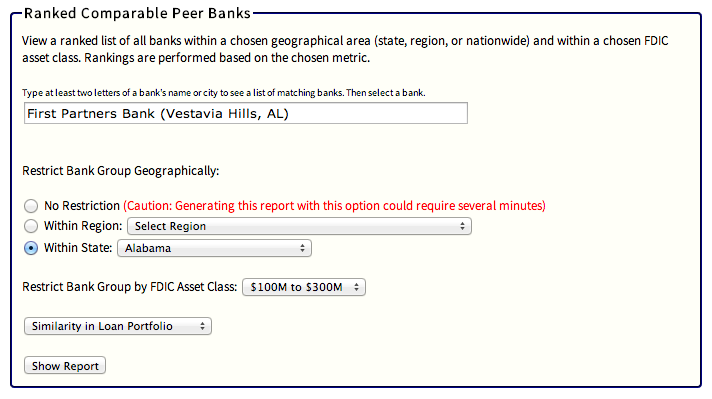

Capitalytics offers a report (under "My Bank" -> "Ranked Comparable Peer Banks") that digs deeper in a selected set of banks in order to identify which banks are truly the most similar to yours. Providing this type of guidance gives a board of directors a better sense of with whom a bank's success should be tracking, and should instill more confidence in the management team.

For example, we benchmarked the 25 banks with assets in the $100M-$300M range that were the most similar to First Partners Bank in Vestavia, AL as of Sept 30, 2012. We benchmarked these banks across four different criteria in order to emphasize that a bank is only a comparable bank within a specific context.

|

|

|

|

In these results, we see that banks, like Oakworth Capital Bank in Birmingham, AL, are very similar when considering the banks' respective loan portfolios, less similar when considering bank size and returns, and not nearly as similar when considering the banks' deposit portfolios. (The colored bars in our tables indicate whether a bank meets a given threshold in terms of similarity. In the first three cases mentioned, Oakworth is still very similar to First Partners Bank, but it is obvious that the similarity varies with the conditions applied.)

If you have questions about which banks are appropriate peers for your market comparisons, contact us today, and we would be glad to help your bank.