The Effects of Culture on Banking Practices

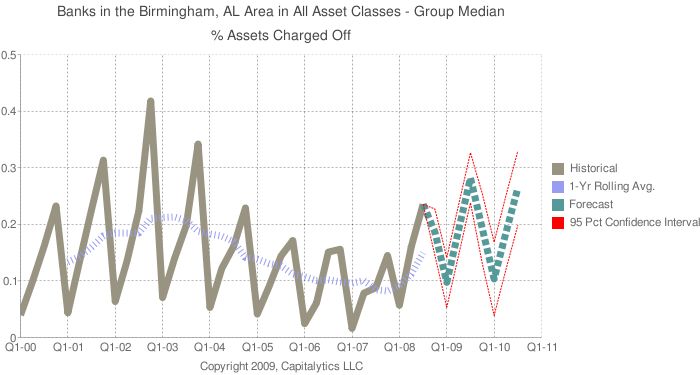

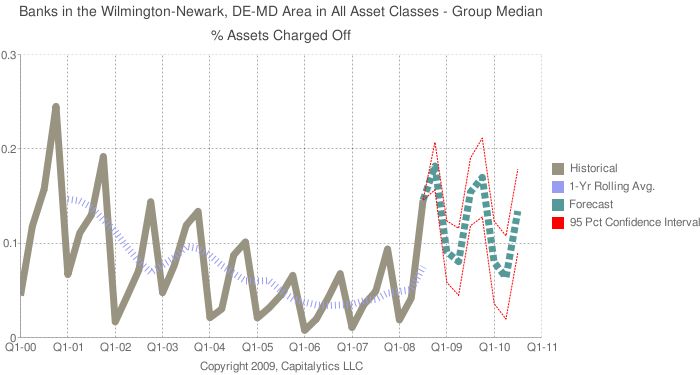

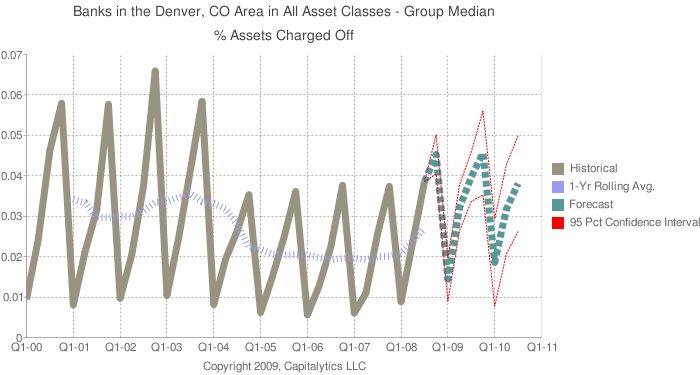

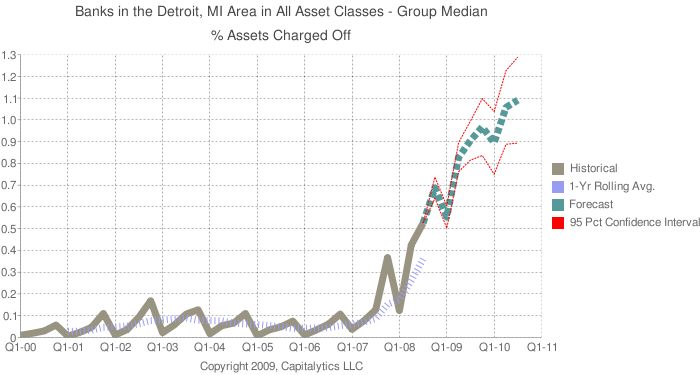

Mon Feb 23, 2009One of the key premises of Capitalytics' analysis processes is that the culture of a community that a bank serves (along with its own policies and procedures) is intrinsically related to the performance of the bank. In the following images, we took several MSAs, and determined the median value for the "% Assets Charged Off" (per quarter) across all banks based on those areas.

|

|

|

|

In the first two images, we see that the median amount that banks in Birmingham, AL and Wilmington, DE charge off between 0.8% and 1.5% of their assets per quarter. The median value for banks based in Denver, CO is approximately 0.28%. However, the median value for banks based in Detroit, MI is approximately 0.38%. (Notice that during 3Q08, the highest 5 MSAs for this metric were Redding, CA with a median value of 0.957%; Naples, FL with a value of 0.969%; Lawton, OK with a value of 1.13%; Merced, CA with a value of 1.45%; and Pueblo, CO with a value of 2.315%.)