Technology Overview

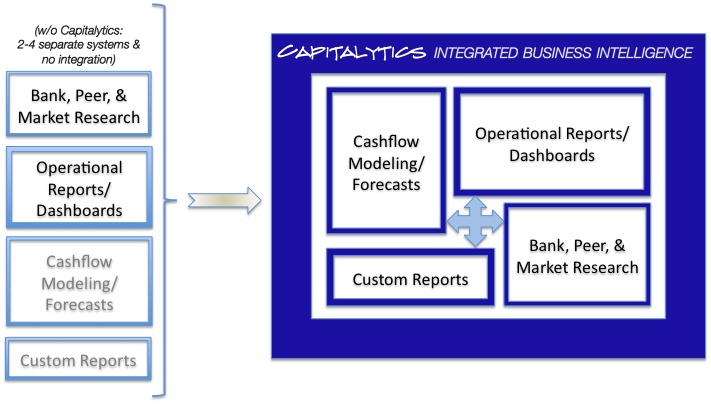

CAPITALYTICS is the only comprehensive, integrated business intelligence service available for bankers. For less than the cost of a single full-time employee (and less than the cost of most of the individual licenses for one of the common services that we replace and extend), Capitalytics' proprietary technology can provide your bank with these benefits .

Technology: Market Research

CAPITALYTICS automatically collects, organizes, and mines information available from public and government-provided databases to make market and peer bank research easy.

| We collect information from | We provide relevant, localized values for | |

|---|---|---|

| Bureau of Economic Analysis, | number of banks, branch offices, and amount of deposits; | |

| Bureau of Labor Statistics, | number of households, and household income; | |

| FDIC, FRB, FFIEC, | population, labor force, and unemployment rate; | |

| Univ. of Missouri, the U.S. Census Bureau, | assets, liabilities, and liquidity; | |

| and the U.S. Postal Service. | and demographic distributions. |

CAPITALYTICS also uses an onboard geocoder, backed up by use of the Texas A&M Geoservices Services , to locate and geographically place banks, branch offices, and bank clients.

Technology: Data Sanitizer

CAPITALYTICS automatically imports bank-provided data, and scans each record against its own proprietary, rule-based library of sanitization algorithms.

By taking this step, Capitalytics helps you maintain consistent data, prevent fraud, and more accurately determine the value of specific client relationships.

Our algorithms identify accounts whose information is invalid, inconsistant, or questionable, based on well known standards, bank-provided guidelines, other pre-existing data, or Capitalytics' own database of information. Once identified, banks can then adjust Capitalytics' data, their own system data, or both to normalize their data in whatever manner they desire.

Technology: Reports

CAPITALYTICS maintains a growing list of dozens of reports (see here ) which are driven by over 500 different attributes, covering a range of banking, demographic, and market metrics.

We collect this information from openly available government sources as it is made available and updated. In some cases, we are able to aggregate data across multiple banks to provide additional value as allowed by agreements with banks, and insofar as the anonymity of data can be preserved.

Capitalytics provides data in multiple relevant formats, and will not withhold your bank's data from you. We always make your underlying data accessible to you in our reports; as an example, we provide all graphed data as a spreadsheet so that you may download the raw data to perform your own analyses.

Technology: Universal Dashboard

CAPITALYTICS' Universal Dashboard is a bank-specific set of panels that highlight issues, successes, and risks that are pertinent to a specific user. A user's panels are driven by the information provided by the bank, ensuring the consistancy of information, presentation, and algorithms for all of the bank's users.

The value of Capitalytics Universal Dashboard is that it enables a clear and malleable channel from the C-level offices of a bank to the retail bank representatives (and everywhere in-between) to provide direction and information.

Typically, our Universal Dashboard panels focus on providing automated yield, client, and production data. This feature is generally used to forward information and incentivize retail representatives as part of their day-to-day production. However, Capitalytics can easily integrate tailored panels and algorithms into the dashboard available to your bank's users.

Technology: Cashflow Engine

CAPITALYTICS' value proposition is to cost-effectively provide pertinent banking and market knowledge to community banks. One technology which Capitalytics has invested in is its own cashflow modeling & forecasting engine. By receiving portfolio information from your bank, Capitalytics is able to project cash-flows under a virtually unlimited set of scenarios, without imposing additional fees.

As a result, your bank can now cost-effectively generate interest rate and liquidity risk models, and impairments (stress tests), as part of strategic planning exercises. Capitalytics automatically integrates internally-generated models for demand accounts and loans. We can also work with your bank (or a third party) on pre-payment models.

Finally, Capitalytics can schedule the execution of specific models on a monthly basis, and then mine and analyze the results to help you understand issues and risks, without being bogged down in the technology.